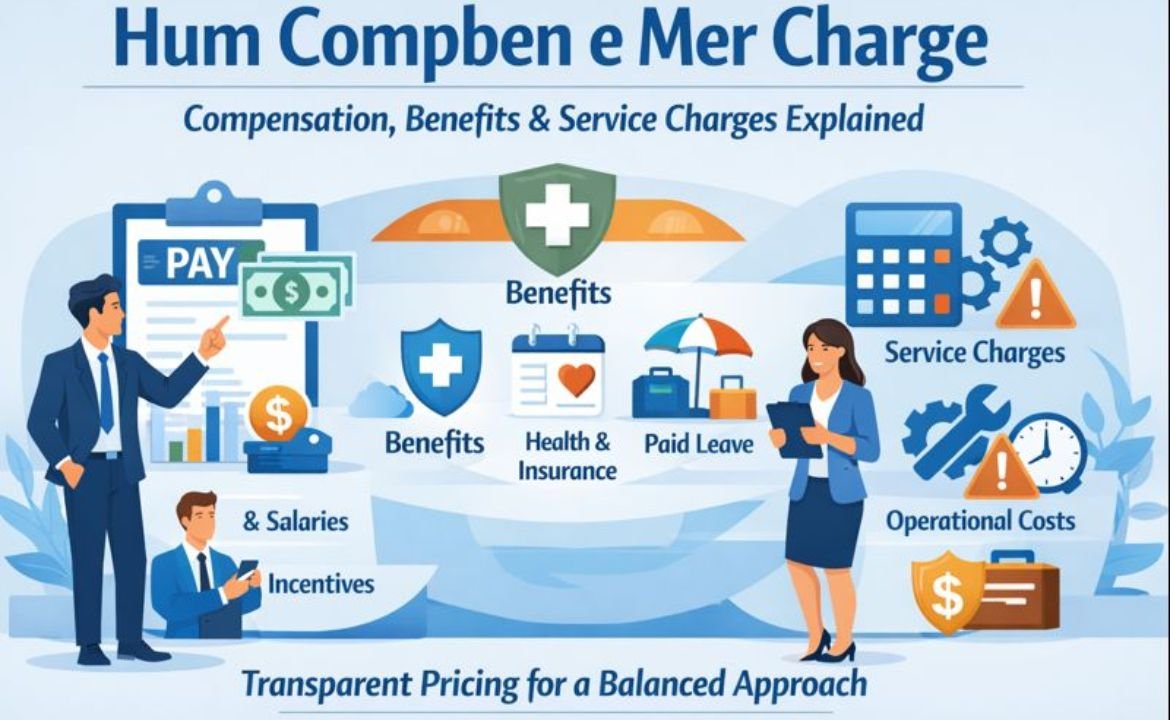

The term Hum Compben e Mer Charge is increasingly appearing in discussions about modern service pricing, compensation systems, and emergency cost adjustments. While the phrase may sound complex, it represents an important concept tied to how organizations balance human compensation, benefits, and merchant-related charges in fast-changing economic environments. Understanding the concept of Hum Compben e Mer Charge helps individuals and businesses make informed financial decisions.

Understanding the Concept of Hum Compben e Mer Charge

Hum Compben e Mer Charge is a combined term that reflects three connected elements.

First, human compensation.

Second, employee benefits.

Third, merchant or service-related charges.

Together, these elements describe how organizations calculate and distribute costs related to labor, benefits, and transactional services. This approach is commonly used in sectors where pricing must adapt quickly to operational demands.

Why This Term Is Gaining Attention

The modern economy is highly dynamic.

Businesses face rising labor costs.

Consumers demand transparency.

As a result, structured charging models are becoming more visible. This is where this concept becomes relevant. It helps explain how costs are grouped, justified, and applied fairly.

The Role of Human Compensation in Cost Structures

Human compensation is the foundation of any organization.

It includes wages, salaries, and performance incentives.

It also reflects skill value and workload.

When companies design pricing or service charges, labor costs are often the largest component. Ignoring them can lead to unsustainable operations.

How Compensation Impacts Final Charges

Higher skill requirements raise costs.

Longer working hours increase expenses.

Specialized expertise adds premium value.

These factors directly influence how charges are calculated and presented to clients or customers.

Employee Benefits and Their Financial Weight

Benefits go beyond basic pay.

They include insurance, paid leave, and wellness support.

Training and career development also count.

Though benefits improve employee satisfaction, they also add measurable costs. Integrating these expenses into a transparent charge system helps maintain balance.

Why Benefits Are Part of the Equation

Employees perform better with security.

Retention improves with strong benefits.

Productivity rises over time.

Including benefits in structured charges ensures long-term stability rather than short-term savings.

Merchant and Service Charges Explained

Merchant charges relate to service delivery, processing, and operational support.

These may include administrative handling, platform usage, or emergency adjustments.

In many industries, these charges are unavoidable. Clear labeling and logical grouping help reduce confusion and build trust.

Emergency and Adjustment Charges

Unexpected situations require fast action.

Extra staffing may be needed.

Operational risks increase.

In such cases, temporary charges may apply to cover immediate costs. When explained properly, these charges feel justified rather than arbitrary.

How Hum Compben e Mer Charge Supports Transparency

One major advantage of this model is clarity.

Customers see what they are paying for.

Businesses can justify pricing decisions.

Instead of vague fees, costs are grouped logically. This reduces disputes and improves understanding on both sides.

Benefits for Consumers

Clear pricing builds trust.

Unexpected fees are minimized.

Decision-making becomes easier.

Transparency is no longer optional. It is an expectation.

Business Advantages of a Structured Charge Model

For businesses, this approach offers control.

Costs are tracked more accurately.

Profit margins are easier to manage.

It also supports compliance and internal audits by clearly separating compensation, benefits, and service-related costs.

Long-Term Sustainability

Sustainable models focus on fairness.

Employees feel valued.

Customers feel respected.

This balance supports growth without sacrificing ethics or efficiency.

Common Misunderstandings Around the Term

Some people assume the term refers to hidden fees.

Others believe it is overly complex.

In reality, the concept exists to simplify cost communication. Misunderstandings usually arise from poor explanation rather than the model itself.

Clearing the Confusion

Simple language helps.

Clear invoices matter.

Consistent usage builds familiarity.

Education plays a key role in acceptance.

Practical Examples in Real Operations

In service industries, labor and benefits form a large part of pricing.

In logistics, emergency staffing may affect charges.

In digital services, platform maintenance adds merchant costs.

By grouping these logically, organizations can respond quickly to changes without constant price restructuring.

Future Outlook and Industry Relevance

As economies evolve, structured cost models will grow.

Remote work changes compensation patterns.

Digital platforms increase service charges.

The concept behind this term aligns well with future demands for clarity, flexibility, and fairness.

Why It Matters Going Forward

Customers want honesty.

Employees want security.

Businesses want efficiency.

A balanced charging approach supports all three.

Final Thoughts

Hum Compben e Mer Charge represents a modern way of understanding combined costs related to people, benefits, and services. Rather than being a confusing term, it highlights the need for transparent, fair, and adaptable pricing structures. When applied correctly, it benefits businesses, employees, and customers alike. In an economy driven by trust and clarity, such structured models are becoming not just useful, but essential.